Acquires BHP’s 17% Interest in Kabanga Nickel Ltd. via Deferred Consideration

NEW YORK -- (BUSINESS WIRE) --

Lifezone Metals Limited’s (NYSE: LZM) Founder and Chair, Keith Liddell, and Chief Executive Officer, Chris Showalter, today announced that Lifezone has completed a definitive agreement with BHP Billiton (UK) DDS Limited (BHP) to acquire BHP’s 17% equity interest in Kabanga Nickel Limited (KNL), the majority owner of the Kabanga Nickel Project in northwestern Tanzania.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250718862553/en/

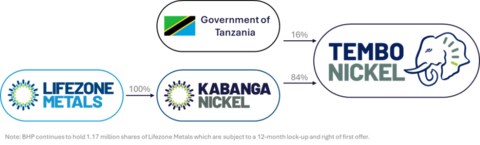

As a result of the transaction, Lifezone owns 100% of KNL, which in turn holds an 84% interest in Tembo Nickel Corporation Limited (TNCL), the Tanzanian operating company for the Kabanga Nickel Project. The remaining 16% of TNCL is held by the Government of Tanzania. All existing agreements with BHP, including the T2 Option Agreement, have been terminated. Lifezone has assumed full control of 100% of the offtake from the Kabanga Nickel Project.

Key terms of the transaction:

- FID Payment: A fixed cash payment of $10 million, payable within 30 days after the earlier of: (i) 12 months after the Final Investment Decision (FID) at Kabanga; or (ii) once Lifezone has raised $250 million in aggregate funding (whether through equity, debt or alternative sources).

- First Commercial Production Payment: A second deferred cash payment, payable within 30 days after the period of 12 months following the achievement of first commercial production. The amount is indexed to Lifezone’s share price performance, with a reference share price of $4.16 per share and a reference amount of $28 million. An index factor of 0.7x applies – meaning that a 10% increase in Lifezone’s share price results in a $1.96 million increase in the payment ($28 million x 10% x 0.7). Based on an illustrative price of $4.50 per share, the payment would total $30 million.

- Total consideration cap: Maximum of $83 million, or reduced to $75 million if the Resettlement Action Plan (RAP) Trigger Event occurs (see below).

- Lock-Up and Right of First Offer: BHP has agreed not to sell its Lifezone shares for 12 months post-completion. After this period, BHP must first offer any shares it intends to sell to Lifezone before potentially transferring them to third parties, subject to customary terms.

Mr. Liddell stated: “This transaction to own 100% of Kabanga Nickel Limited allows Lifezone to fully align our technical, commercial, and ESG strategy as we advance Kabanga toward the Final Investment Decision. We are committed to delivering the project responsibly and to creation of long-term value for all our stakeholders.”

Mr. Showalter added: “This marks a significant milestone for Lifezone as we consolidate ownership of the Kabanga Nickel Project. BHP has been a supportive and value-adding partner whose investment has contributed to advancing the project, and their exit coincides with the project’s transition into its next stage of development. Our focus remains on delivering a world-class, low-cost nickel project that benefits all stakeholders, including the Government of Tanzania and local communities.”

Ongoing strategic financing initiatives to advance to Final Investment Decision

Standard Chartered Bank – Short-term financing and strategic advisory

Lifezone has engaged Standard Chartered Bank as financial adviser to support the development of the Kabanga Nickel Project. A short-term development financing package is well advanced, to provide sufficient capital to undertake early works construction and Resettlement Action Plan activities and to progress through to Final Investment Decision, including proceeding to financial close of the multi-source project finance package.

Lifezone is also in active discussions with several major, diversified counterparties regarding long-term strategic partnerships.

Societe Generale – Project finance progress

As announced on September 23, 2024 (refer to Lifezone’s news release), Societe Generale is advising Lifezone on the project financing process. This includes potential support from the U.S. International Finance Corporation (DFC) through loans and risk insurance (refer to Lifezone’s August 27, 2024 news release). The project financing process, which commenced well ahead of the release of the Kabanga Feasibility Study, is progressing well and meaningful interest has been received from potential lenders, including export credit agencies.

These initiatives aim to deliver a capital structure aligned with Lifezone’s growth ambitions and Kabanga’s development timeline. While BHP’s exit marks a transition, it also presents a unique opportunity to reshape the Kabanga ownership and financing strategy to suit Lifezone’s aspiration of long-term value creation.

The RAP Trigger Event and ESG alignment

The RAP Trigger Event is defined as the independent verification that the project’s Resettlement Action Plan has been developed and implemented in material alignment with the International Finance Corporation’s Performance Standard 5 (IFC PS5).

If confirmed within 12 months of completion, the total consideration payable to BHP will be reduced to a maximum of $75 million.

If you would like to sign up for Lifezone Metals news alerts, please register here.

Social Media

About Lifezone Metals

Lifezone Metals (NYSE: LZM) is committed to delivering cleaner and more responsible metals production and recycling. Through the application of our Hydromet Technology, we offer the potential for lower energy consumption, lower emissions and lower cost metals production compared to traditional smelting.

Our Kabanga Nickel Project in Tanzania is believed to be one of the world's largest and highest-grade undeveloped nickel sulfide deposits. By pairing it with our Hydromet Technology, we are working to unlock a new source of nickel, copper and cobalt for the global battery metals markets and to empower Tanzania to achieve in-country beneficiation.

Through our US-based recycling partnership, we are working towards applying our Hydromet Technology to the recovery of platinum, palladium and rhodium from responsibly sourced spent automotive catalytic converters. Our process is expected to be cleaner and more efficient than conventional smelting and refining methods, supporting a circular economy for precious metals.

Forward-Looking Statements

Certain statements made herein are not historical facts but may be considered “forward-looking statements” within the meaning of the Securities Act of 1933, as amended, the Securities Exchange Act of 1934, as amended, and the “safe harbor” provisions under the Private Securities Litigation Reform Act of 1995 regarding, amongst other things, the plans, strategies, intentions and prospects, both business and financial, of Lifezone Metals Limited and its subsidiaries.

Generally, statements that are not historical facts, including statements concerning possible or assumed future actions, business strategies, events or results of operations, and any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Forward-looking statements may be accompanied by words such as “believes,” “estimates,” “expects,” “predicts,” “projects,” “forecasts,” “may,” “might,” “will,” “could,” “should,” “would,” “seeks,” “plans,” “scheduled,” “possible,” “continue,” “potential,” “anticipates” or “intends” “or the negatives of these terms or variations of them or similar terminology or expressions that predict or indicate future events or trends or that are not statements of historical matters; provided that the absence of these does not mean that a statement is not forward-looking. These forward-looking statements include, but are not limited to, statements regarding future events, the estimated or anticipated future results of Lifezone Metals, future opportunities for Lifezone Metals, including the efficacy of Lifezone Metals’ hydrometallurgical technology (Hydromet Technology) and the development of, and processing of mineral resources at, the Kabanga Nickel Project, our approach to environmental stewardship, social responsibility, safety and governance (ESG), and other statements that are not historical facts.

These statements are based on the current expectations of Lifezone Metals’ management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on, by any investor as a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Lifezone Metals and its subsidiaries. These statements are subject to a number of risks and uncertainties regarding Lifezone Metals’ business, and actual results may differ materially. These risks and uncertainties include, but are not limited to: general economic, political and business conditions, including but not limited to economic and operational disruptions; global inflation and cost increases for materials and services; capital and operating costs varying significantly from estimates; delays in obtaining or failures to obtain required governmental, environmental or other project approvals; changes in government regulations, legislation and rates of taxation; inflation; changes in exchange rates and the availability of foreign exchange; fluctuations in commodity prices; delays in the development of projects and other factors; the outcome of any legal proceedings that may be instituted against Lifezone Metals; our ability to obtain additional capital, including use of the debt market, future capital requirements and sources and uses of cash; the risks related to the rollout of Lifezone Metals’ business, the efficacy of the Hydromet Technology, and the timing of expected business milestones; the acquisition of, maintenance of and protection of intellectual property; Lifezone’s ability to achieve projections and anticipate uncertainties (including economic or geopolitical uncertainties) relating to our business, operations and financial performance, including: expectations with respect to financial and business performance, future operating results, financial projections and business metrics and any underlying assumptions; expectations regarding product and technology development and pipeline and market size; events relating to environmental issues, social responsibility, safety and/or governance matters, expectations regarding product and technology development and pipeline; future acquisitions, partnerships, or other relationships with third parties; maintaining key strategic relationships with partners and customers; the timing and significance of contractual relationships; the effects of competition on Lifezone Metals’ business; the ability of Lifezone Metals to execute its growth strategy, the development and processing of the mineral resources at the Kabanga Nickel Project; manage growth profitably and retain its key employees; the ability of Lifezone Metals to reach and maintain profitability; enhancing future operating and financial results; complying with laws and regulations applicable to Lifezone Metals’ business; Lifezone Metals’ ability to continue to comply with applicable listing standards of the NYSE; our ability to comply with applicable laws and regulations, stay abreast of accounting standards, or modified or new laws and regulations applying to our business, including privacy regulation; and other risks that will be detailed from time to time in filings with the U.S. Securities and Exchange Commission (SEC); meeting future liquidity requirements and complying with restrictive covenants related to long-term indebtedness; and dealing effectively with litigation, complaints, and/or adverse publicity.

The foregoing list of risk factors is not exhaustive. There may be additional risks that Lifezone Metals presently does not know or that Lifezone Metals currently believes are immaterial that could also cause actual results to differ from those contained in forward-looking statements. In addition, forward-looking statements provide Lifezone Metals’ expectations, plans or forecasts of future events and views as of the date of this communication. Lifezone Metals anticipates that subsequent events and developments will cause Lifezone Metals’ assessments to change.

These forward-looking statements should not be relied upon as representing Lifezone Metals’ assessments as of any date subsequent to the date of this communication. You should not place undue reliance on forward-looking statements in this communication, which are based upon information available to us as of the date they are made and are qualified in their entirety by reference to the cautionary statements herein. In all cases where historical performance is presented, please note that past performance is not a credible indicator of future results.

Except as otherwise required by applicable law, we disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, new information, data, or methods, future events, or other changes after the date of this communication.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250718862553/en/

CONTACT:

Investor Relations – North America

Evan Young

SVP: Investor Relations & Capital Markets

evan.young@lifezonemetals.com

Investor Relations – Europe

Ingo Hofmaier

Chief Financial Officer

ingo.hofmaier@lifezonemetals.com

Figure 1: Kabanga Nickel Project ownership structure.